During bouts of short-term underperformance and/or significant volatility in stock prices, it’s easy to throw in the towel and get out of them to relieve the psychological stresses that result. I believe that this is the worst thing an investor can do because doing so will cause temporary underperformance and/or losses to become permanent ones. It is difficult to stay the course – I get that. But it is crucial to do so because even the best long-term winners in the stock market can make our stomachs churn in the short run.

Don’t believe me? I’ll show you through a game. All you have to do is to answer two questions that involve two groups of real-life companies. Please note your answers for easy reference when you see the questions (it’ll be fun, trust me!).

Figure 1 below is a chart showing the declines from a recent-high for the S&P 500 and the stock prices of the first group of companies (Company A, Company B, and Company C) from the start of 2010 to the end of 2021. The chart looks brutally rough for the three companies. All of them have seen stock price declines of 20% or more on multiple occasions in that time frame. Moreover, their stock prices were much more volatile than the S&P 500 – the index experienced a decline of 20% or more from a recent high just once (in early 2020). So the first question is, after seeing Figure 1, would you want to own shares of the first group of companies if you could go back in time to the start of 2010?

Table 1 below illustrates the stock price and revenue growth for the second group of companies (Company D, Company E, and Company F) from the start of 2010 to the end of 2021, along with the S&P 500’s gain. The second trio of companies have generated tremendous wealth for their investors, far in excess of the S&P 500’s return, because of years of rapid business growth. The second question: If you could travel to the start of 2010, would you want to own shares of the companies in the second group?

My guess for the majority of responses for the first and second questions would be “No” and “Yes”, respectively. But what’s interesting here is that both groups refer to the same companies! Company A and Company D are Amazon; B and E refer to MercadoLibre, and C and F are Netflix. There’s more to the returns of the three companies from 2010 to 2021. Table 2 below shows that the trio have each: (a) underperformed the S&P 500 in a few calendar years, sometimes significantly; and (b) seen their stock prices and business move in completely opposite directions in some years.

*Revenue growth numbers for 2021 are for the first nine months of the year

There are two other interesting things about the stock price movements of Amazon, MercadoLibre, and Netflix.

First, in every single time-frame between the start of 2010 and the end of 2021 that has a five-year or longer holding period (with each time-frame having 31 December 2021 as the end point), there is not a single time-frame where the annualised return for each of the three companies is negative or lower than the S&P 500’s. For perspective, the minimum and maximum annualised returns for the trio and the S&P 500 are given in Table 3. If you had invested in the three companies at any time between 1 January 2010 and 31 December 2016, and held onto them through to 31 December 2021, you would have not only significantly beaten the S&P 500 for any start-date, you would also have earned high annual returns.

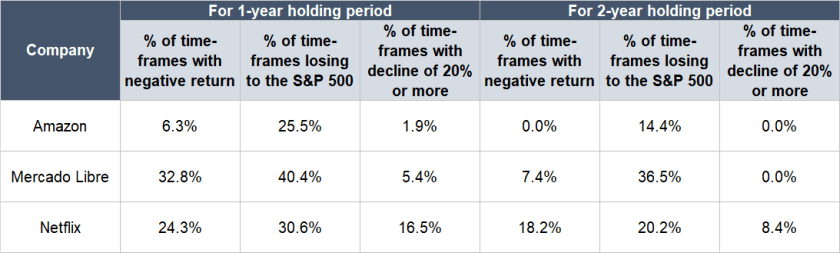

Second, the returns for Amazon, MercadoLibre, and Netflix for all the same start-dates as in the data shown in Table 3, but this time for shorter holding periods of 1 year and 2 years, have been all over the place. This is displayed in Table 4. Notice the common occurrence of negative as well as market-losing returns for the three companies for both 1-year and 2-year holding periods.

After sweeping up all the data shown in Figure 1 and Tables 1, 2, 3, and 4, the critical highlights are these:

- By looking at just the long-term returns that Amazon, MercadoLibre, and Netflix have produced, it’s difficult to imagine that their stock prices had to traverse brutally rough terrains to reach their incredible summits. But this is the reality that comes with even the best long-term winners. It’s common for them to have negative and/or market-losing returns over the short-term even as they’re on the path toward fabulous long-term gains. For example, an investor who invested in Amazon on 9 December 2013 would be sitting on a loss of 20.4% one year later while the S&P 500 was up by 16.3%. But someone who invested in Amazon on 9 December 2013, and held on till 31 December 2021, would have earned an annualised gain of 30.7%, way ahead of the S&P 500’s annual return of 15.0% over the same period. In another instance, MercadoLibre’s stock price fell by 20.6% one year after 29 September 2014, even though the S&P 500 inched down by just 2.7%; on 31 December 2021, the compounded returns from 29 September 2014 for MercadoLibre and the S&P 500 were 41.4% and 15.1%, respectively. Meanwhile, an investor buying Netflix’s shares on 3 August 2011 would be facing a massive loss of 79.3% one year later, even as the S&P 500 had gained 10.7%. But Netflix’s annualised return from 3 August 2011 to 31 December 2021 was an impressive 30.7%, nearly twice the 15.9% annual gain seen in the S&P 500.

- A company’s stock price can exhibit stomach-churning short-term volatility even when its underlying business is performing well. For example, Amazon’s robust 19.5% revenue growth in 2014 came with a 22.2% stock price decline, MercadoLibre’s stock price was down by 10.4% in 2015 despite revenue growth of 17.1%, and Netflix’s 48.2% revenue growth in 2011 was accompanied by a 60.6% collapse in its stock price. Significant short-term deviations between a company’s business performance and stock price is simply a feature of the stock market, and not a bug.

- Having to suffer through an arduous journey is the price we have to pay (the fee for admission!) to reach the top of the mountain, but it’s a journey that is worth being on.

Accepting that volatility is a feature of stocks can lead to a healthy change in our mindset toward investing. Instead of seeing short-term volatility as a fine, we can start seeing it as a fee – the price of admission, if you will – for great long-term returns. This is an idea that venture capitalist Morgan Housel (who also happens to be one of my favourite finance writers) once described in a fantastic article of his titled Fees vs. Fines.

Seeing volatility as a fee can also help all of us develop a crucial character trait when dealing with the inevitable ups and downs in the financial markets: Equanimity. Being able to remain calm when stock prices are roiling is important because it prevents us from making emotionally-driven mistakes. Another thing that can help strengthen the equanimity-fibre in our psyche is to focus on business results. Stock prices and business growth converge in the long run. But over the short run, anything can happen.

It’s never fun to deal with falling stock prices. But as Josh Brown, CEO of Ritholtz Wealth Management and one of my favourite market commentators, wrote in a recent blog post: “Returns only come to those who are willing to bear that volatility when others won’t. The volatility is the point.”

Disclaimer: The Good Investors is the personal investing blog of two simple guys who are passionate about educating Singaporeans about stock market investing. By using this Site, you specifically agree that none of the information provided constitutes financial, investment, or other professional advice. It is only intended to provide education. Speak with a professional before making important decisions about your money, your professional life, or even your personal life. Of all the companies mentioned, I currently have a vested interest in Amazon, MercadoLibre, and Netflix. Holdings are subject to change at any time.